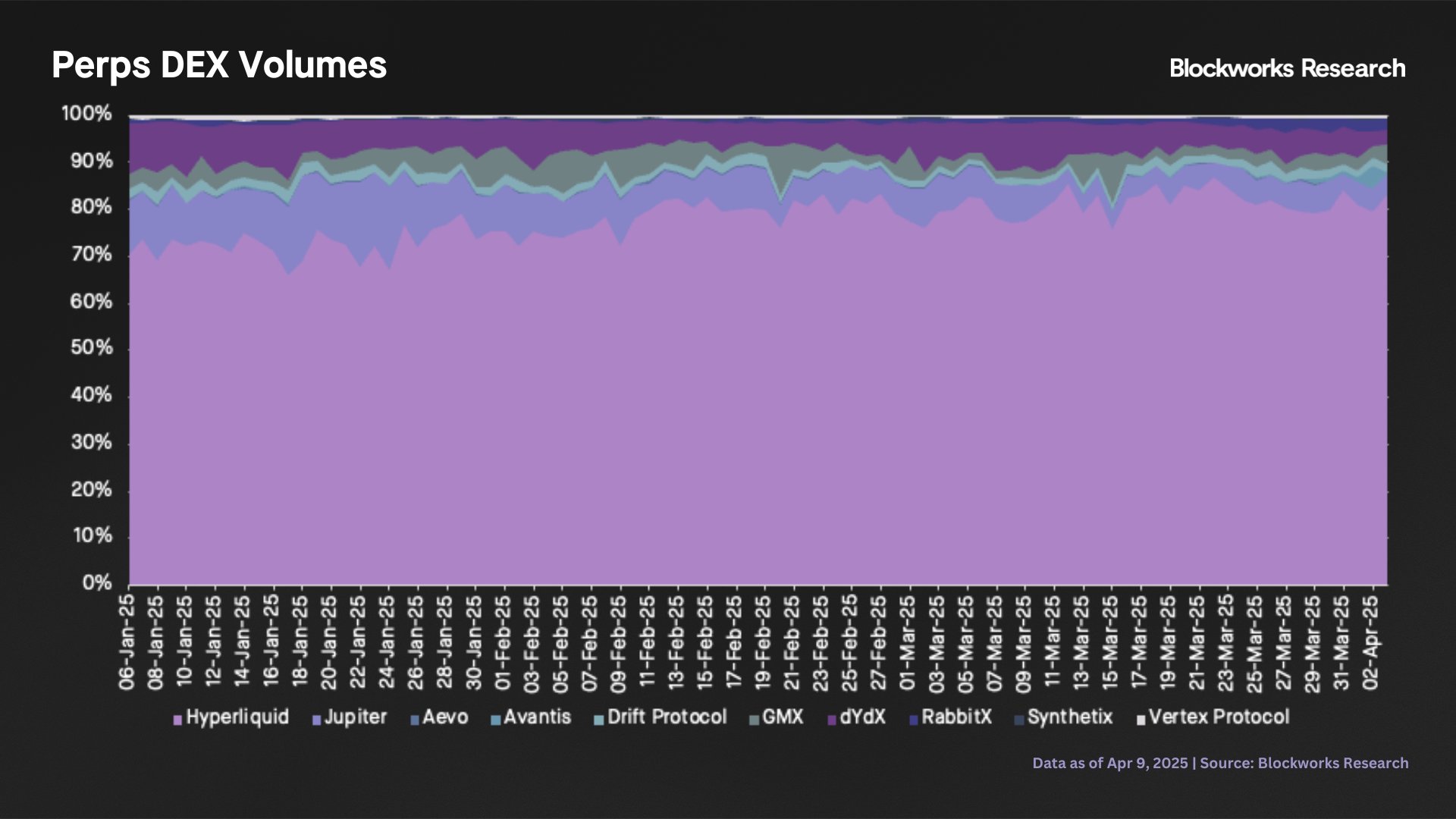

A leading crypto analytics firm has revealed that the layer-1 blockchain HYPERLIQUID is currently dominating the decentralized perpetual futures trading market. In a recent social media thread on X, BLOCKWORKS reported that HYPERLIQUID now accounts for nearly 80% of perpetual futures trading volume in the decentralized exchange (DEX) space.

According to the firm, HYPERLIQUID‘s success can be attributed to its effective token-listing strategy and exceptional user experience (UX). The platform has emerged as the only DEX capable of competing with centralized exchanges (CEXs) in terms of trading volumes. Over the past three months, HYPERLIQUID has averaged an impressive $6.4 billion in daily trading volume, surpassing 50% of the daily volumes recorded by BYBIT and OKX.

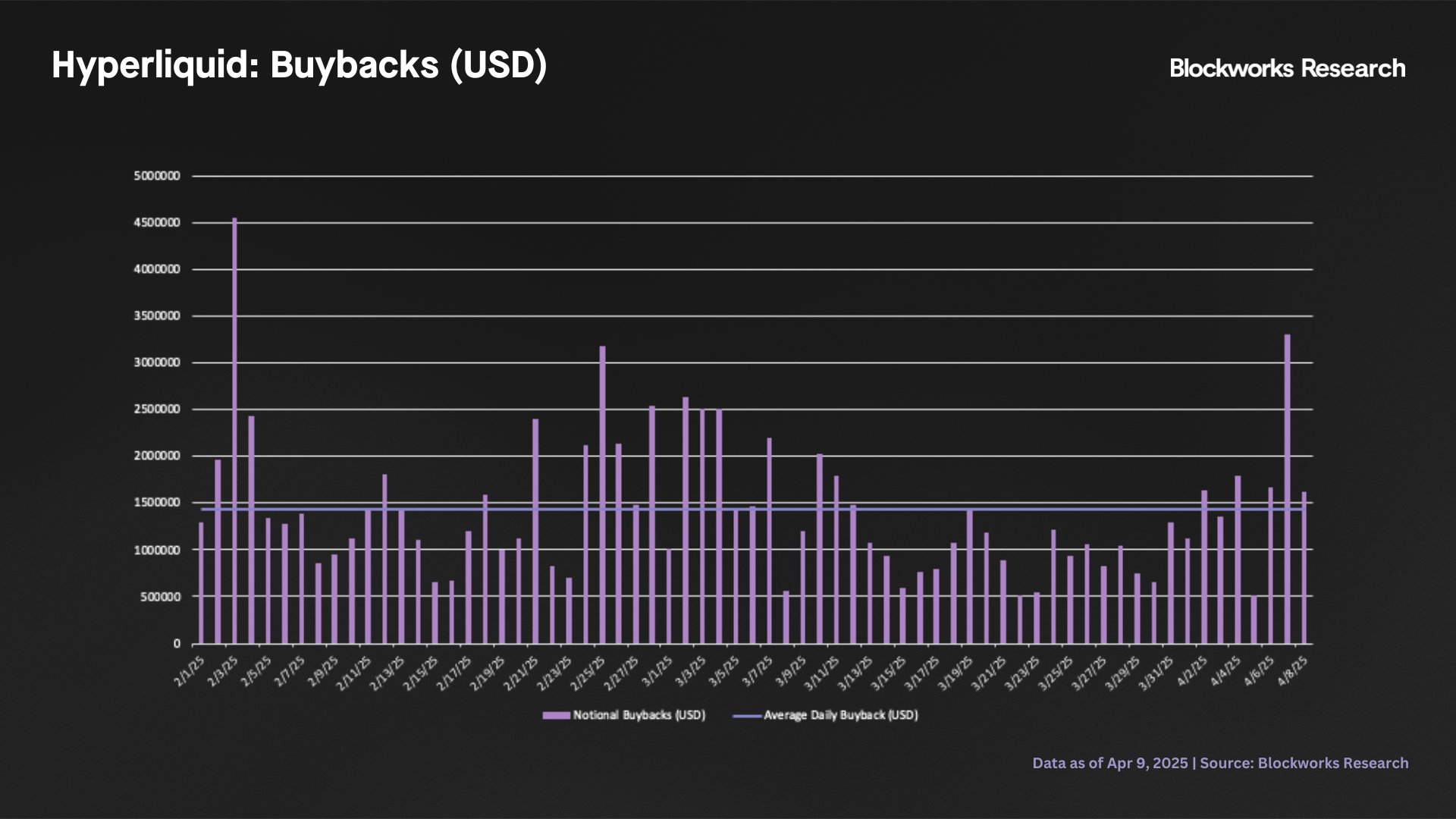

BLOCKWORKS also highlighted HYPERLIQUID‘s innovative trading engine, HYPERCORE, which has generated significant capital for the platform. The fees collected on HYPERCORE are allocated between the Hyperliquidity Provider (HLP) and the assistance fund. The assistance fund utilizes these fees to buy back the HYPE token. Since February, the fund has purchased a cumulative $96 million worth of HYPE, averaging $1.4 million daily.

Looking ahead, BLOCKWORKS predicts that HYPERLIQUID will continue to grow, potentially challenging its centralized counterparts. “We expect HYPERCORE to start competing with CEXs and taking market share away from them, while continuing its dominance in the decentralized perpetuals space,” the firm stated.

At the time of writing, HYPE is trading at $18.01.

Source: BLOCKWORKS/X